The Rise of Pop Mart Closely Resembles the Rise of Crypto – Coincidence?

Last year, a series of drink vending machines opened up in a hollow recess at the storefronts of Sanlitun Soho facing Gongti Beilu. The prices are moderate enough – around RMB 5 per can – but the catch is that you can’t choose your own drink. You might get a soda, or you might get a peach juice. The fact that such machines are even remotely viable are a testament to how deeply the phenomenon of “blind box” buying has penetrated Chinese culture.

Just about every major company operating in China – from Xiaomi to McDonald's – has attempted a blind box marketing ploy in one form or another. But certain brands build their entire business model around blind boxes, and chief among these is the toy brand Pop Mart.

Since its rise, Chinese media has taken note of the peculiar effect Pop Mart has on its fans, often describing their shopping behavior as addictive. Shoppers have even been seen shaking the boxes like children under a Christmas tree, trying to guess the contents. And, when guessing correctly, they've said they feel a thrill comparable to winning a hand at blackjack. By 2017, China News (linked above) had no trouble finding a young person who was spending half of their RMB 8000 monthly income on Pop Mart toys.

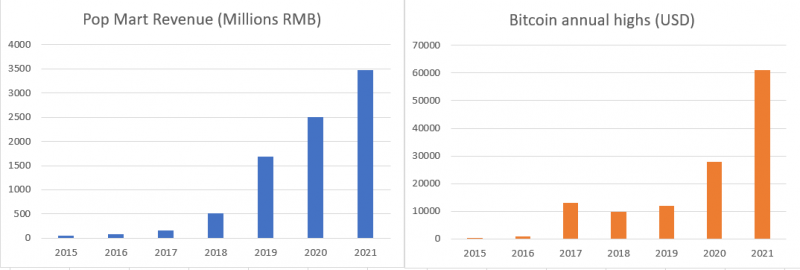

Curiously, a quick look at Pop Mart’s growth since 2010 might look familiar to followers of contemporary economic trends. That’s because it resembles the climbing price of Bitcoin over the same period. True, Bitcoin price has fluctuated while Pop Mart revenue has steadily risen, but this is to be expected given their difference in nature, the former being a currency and the latter a corporation.

Yet, there are a few key similarities that shouldn't be overlooked. Both began within a year of each other (Bitcoin launched in 2009, Pop Mart was founded in 2010) and were more or less stagnant until 2015 when they both began to spike, and each has risen substantially since that time. Finally, both absolutely skyrocketed in 2021.

So, is it a mere coincidence that the giant of cryptocurrency and the behemoth of blind box toys are following the same general trajectory, or is there more to it? Further, is there a reason that the blind-boxification of, well, everything up to and including canned drinks began happening at roughly the same time that NFTs began commodifying every jpg and mp3 on the Internet?

Skeptical readers will be quick to point out that many economists have called the crypto craze a bubble – one that closely follows consumer bubbles of the past, from tulips to Beanie Babies. I’ll admit, that is probably true. But even in both crypto and blind boxes are another example of consumer bubbles (though it’s a bit harder to make that case for the latter), why are they happening concurrently, reflecting each other in real-time?

This is clearly a case where correlation does not equal causation, but that doesn’t mean that there is no relationship at all.

When I first noticed the relationship between blind boxes and crypto, I couldn’t help but note that the largest bump in Pop-Mart sales occurred in 2019, which happens to be the same year that China banned crypto trading. Could it be, I asked myself, that Chinese crypto traders, left stranded without a hobby, had turned to a new form of trading to fill the void?

But this hypothesis doesn’t hold much water when you look into the demographic differences between crypto traders and Pop Mart customers. Worldwide, crypto traders are about 2/3 men, whereas the opposite is true for blind box buyers, who are about 2/3 women. By age, millennials age 25-40 make up about 76 percent of crypto traders, while about 85 percent of blind box buyers are under age 20.

Then, there’s the issue of why people are buying these things in the first place. While crypto heads may push some philosophical (read: libertarian) arguments to bolster their argument in favor of crypto, it’s frankly hard to believe they aren’t hoping to turn a profit on their investment at some point, as many people already have.

But Pop-Mart shoppers don’t necessarily think like this. A moderately-sized study from 2021 suggested that just 18 percent of blind box buyers say they buy toys in order to hawk them at a premium later down the road. The majority of buyers – around 60 percent, the study says – are buying just because they think the toys are cute.

So, if there is little connection between who is buying, and a limited connection between their motives for buying, then is there an outside force – a third factor that could be driving the rise of both crypto prices and blind box buying? I think there is.

As we have discussed, studies on the psychology behind both of these phenomena give varying weight to the motives that buyers cite, but they do seem to agree on one thing. Crypto heads and blind box toy fans are, in general, avid social media users, and in many cases are manipulable by social media influencers.

We might, then, hazard a guess that the development and proliferation of social media is not just playing a key role in these phenomena, but that they are the root cause behind them. If our guess is correct, then we would expect to find some quantifiable aspect of social media that has followed the same trend over the past decade, say, for instance, the estimated market size of influencer marketing. Lo and behold, that’s exactly what we find.

The annual growth of influencer marketing averages around 50 percent annually from 2016-2021 – about the same average for Pop Mart growth since 2017, and, despite its fluctuations, not far off from the 40 percent average growth we see in Bitcoin price over the same time period.

Now, we might suspect causation if we had only noticed the correlation between influencer growth and Pop Mart, and the same could be said of influencer growth and Bitcoin. But the fact that we see a parallel relationship for two otherwise seemingly unrelated markets bolsters the idea that pumped-up online influence is behind both phenomena.

It's no secret, of course, that influencers are having an enormous impact on what we buy – but the simultaneous rise of cryptocurrency and blind box toys suggests that they are causing us to buy whole new types of products that we never would have considered without them – and, perhaps, occasionally inducing massive economic bubbles along the way.

READ: Fast Food Watch: Get a Little Green With McDonald's Limited-Time Cilantro-Flavored Ice Cream

Images: Sina, China Times, Joey Knotts (graphs made with Excell), Windmemories via Wikimedia, Statista